streamlining economic priorities—how is this shifting policy?

top-level economic guidance streamlined to 'four stabilities'

new concentration to shore up jobs and the economy

'stabilise firms’ replaces 'stabilise finance' at second place

Launching a new(ish) 'four stabilities' framework, the late April Politburo meeting has pivoted macropolicy. Building domestic resilience to external risk, the new focus aligns with the ubiquitous 'doing our own thing well' mantra. Even more, it underscores the trade war headwinds, indicating a renewed priority on the domestic market and support for productive employment-generating firms, over finance.

External dependencies might then seem weakness: foreign trade and investment are indeed missing from the headline slogan. Yet they are not missing from the picture. The evolution and shift in frameworks warrant a closer look.

stabilising stability

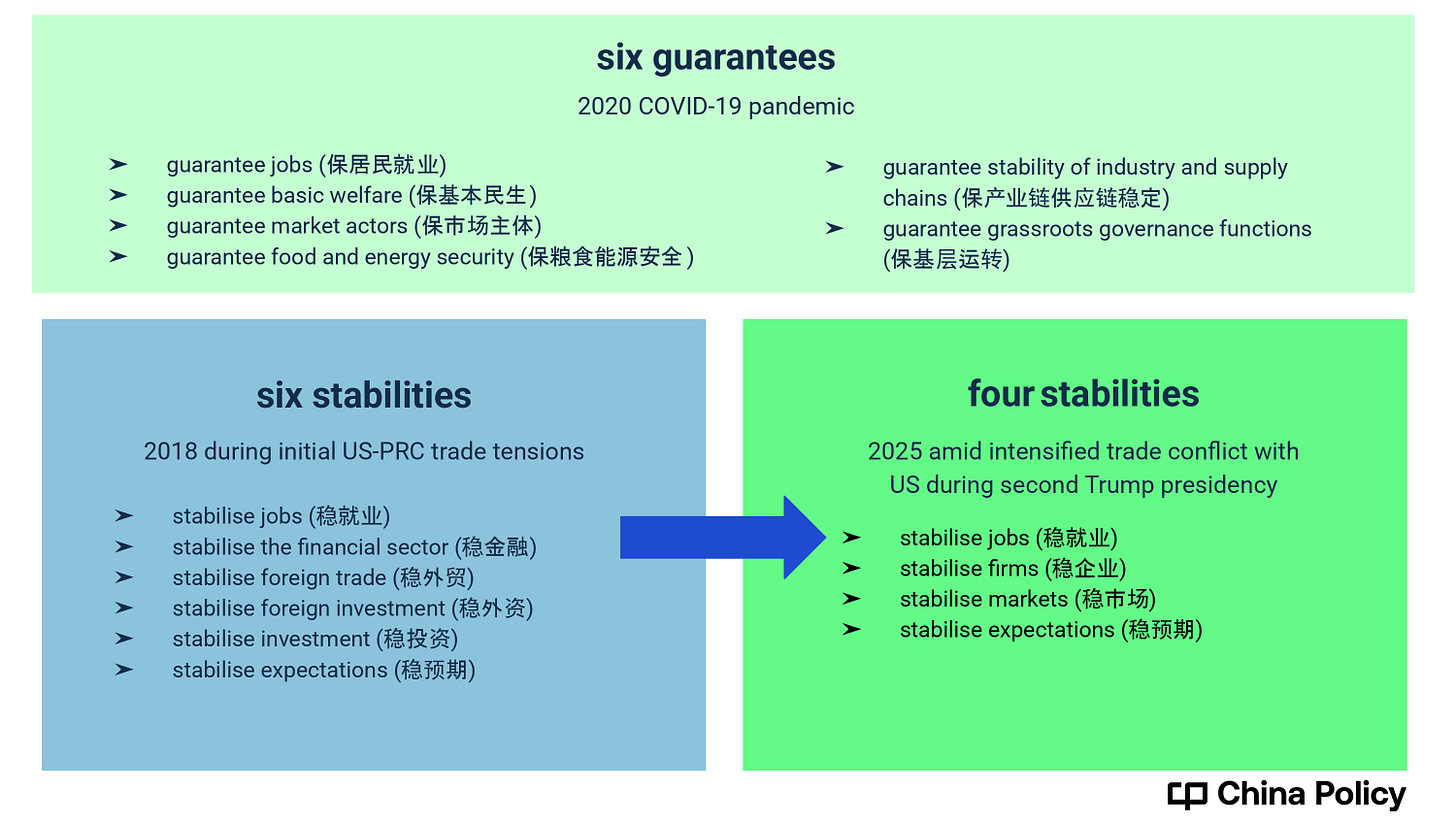

Older slogans had held sway since the pandemic. 'Six stabilities' were the order of the day from July 2018 and through the Trump 1.0 US–PRC trade tensions, the target being broad stability

As the pandemic emergency struck in early 2020, the slogan expanded to 'six stabilities, six guarantees'.

The guarantees 'anchored' the stabilities, re-setting priorities in the crisis, and shifting from a purely growth focus to more balanced measures, stressing social welfare and essential services.

Facing ever greater trade conflict with the US under Trump 2.0, Beijing has streamlined its approach. The 'four stabilities' now shore up: jobs, firms, markets and expectations.

Across all three iterations since 2018, jobs have held the top position. For Beijing, a steady jobs market is closely tied to economic performance, and in turn, to social stability —a political priority that outweighs most others.

enterprise over finance: pivoting in crisis

The shift to 'four stabilities' reveals a major change in the second priority. In the 2019 framework, 'stabilise the financial sector' held second place after jobs. At the April 2025 Politburo meeting, it is replaced by 'stabilise firms’.

With tariff impacts bad enough and threatening to worsen, enterprise stability is promoted to number two: a 'deep shift in the logic of economic governance' argues Wang Qing 王青 Orient Golden Credit Rating. Resilient firms come in from the cold as 'anchor points' for stable employment.

Reinforcing 'capillaries' (firms) is hence badged as the optimum way to weather external shock and ensure jobs. Actors in the real economy outweigh financial institutions.

The State Council swiftly enacted this approach. A policy package impacting jobs, trade, consumption, investment, and business environment was unveiled by Zhao Chenxin 赵辰昕, National Reform and Development Commission, on 7 May. Measures ran to stepped-up bond issuance and interest rate cuts. ‘Again ‘, doing our own thing well, is sounded throughout: stable domestic growth must counter global uncertainty.

Supporting businesses directly becomes the optimum approach to withstanding trade pressures and keeping jobs buoyant. This prioritises real economy actors over financial institutions. Given trade conflicts, Beijing now views helping actual businesses as outweighing financial system stability—a serious change in policy priorities.

pragmatic consolidation

Macro levers are expected to become proactive, targeted to support the four stabilities. This entails stepping up fiscal support (i.e. bond issuance) and monetary easing (timely RRR and rate cuts), already in train, with new monetary tools. Crucially, multi-pronged ‘combo punches’ are awaited, directly assisting distressed firms, above all those hit by tariffs.

The ‘stability’ shift is pragmatic, given global headwinds. Shoring up domestic pillars—jobs, firms, market functioning, and confidence—and placing enterprise stability immediately under jobs, the national economy is fortified against ‘high tides and strong currents’.

Evolution from the Six Stabilities, to the pandemic-focused Six Stabilities and Six Guarantees, to the streamlined Four Stabilities traces macro adaptation to changing domestic and global circumstances. It represents not just a tactical adjustment but a deeper reorientation of PRC macro governance, prioritising internal resilience.

profiles

Wang Qing 王青 | Golden Credit Rating International chief economist

Promoting 'stabilise firms' to second place represents a paradigm shift. When trade tensions escalated in 2018, fears of market contagion led to a prioritisation of financial stability. Facing harsher trade measures, the switch is to directly support ‘real’ businesses, rather than working via financial bodies.

Financial help targeting firms hit by tariffs will be rolled out, with support for supply chains and the business environment. Financial bodies won’t thereby lose importance— support will be in terms of bolstering ‘real economy’ actors. Resilience against external pressures while maintaining economic momentum will be the goal.

A PhD graduate from Tsinghua University, Wang is a prominent figure in the domestic financial media. He has spent the majority of his career in the private sector.

Luo Zhenheng 罗志恒 | Yukai Securities chief economist

The renewed focus on businesses, argues Luo, is strategic, not TLC: trade, investment, and crucially, employment depend on them for stability. Their elevation in status shows the economy’s capillary nature, in which firms are fundamental units of stability. Previous emphasis on financial stability, while important, yielded resilience more indirectly.

Taking a doctorate in economics at the MoF-affiliated Chinese Academy of Fiscal Sciences, Luo worked for some of the PRC’s largest securities firms. He regularly advises Beijing and sits on roundtables organised by central agencies, such as the NDRC and MoF.

context

28 Apr 2025: the State Council press conference introduces a policy package to support 'four stabilities', emphasising direct enterprise support measures

25 Apr 2025: Politburo meeting introduces the 'four stabilities' (四稳) framework, replacing the 'six stabilities, six guarantees' slogan

8 Mar 2025: Premier Li Qiang's Government Work Report at the NPC emphasises 'steadfastly managing our own affairs well' amid external uncertainties

9 Apr 2025: Trump administration announces new round of tariffs targeting Chinese manufacturing exports

15 Jan 2025: PRC economic data shows sustained pressure on industrial enterprises from global trade tensions

6 Sept 2020: late Premier Li Keqiang presides State Council executive meeting to introduce measures to support 'six stabilities' (六稳)

20 Apr 2020: Politburo meeting introduces 'six guarantees' (六保) alongside 'six stabilities'

31 Jul 2018: Politburo meeting introduces 'six stabilities' (六稳) framework amid initial US–China trade tensions